The World Economic Forum Annual Meeting 2026 took place in Davos, Switzerland, bringing together heads of state, central bankers, international institutions, and senior executives from across the global economy. While geopolitical tensions formed the broader backdrop of the meeting, discussions on economics and technology dominated many of the sessions, with particular attention given to economic resilience, artificial intelligence, labor markets, energy systems, and global growth capacity.

Global Economic Outlook and Resilience

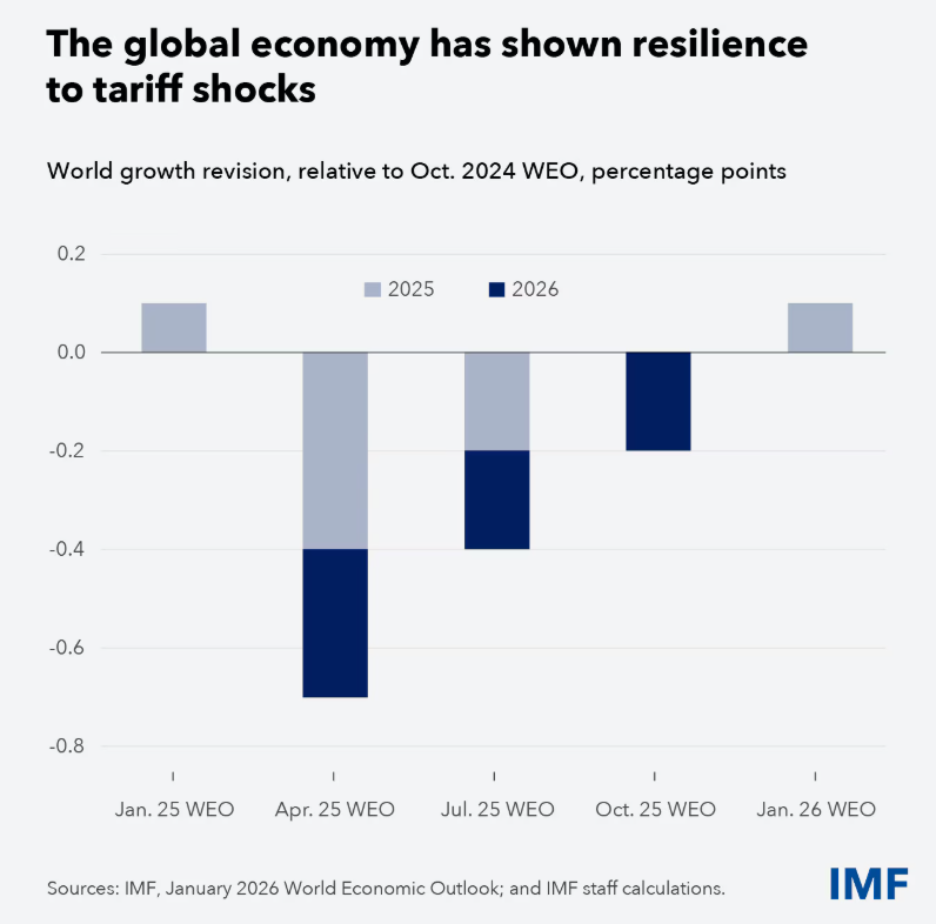

One of the most closely followed economic contributions came from the International Monetary Fund. According to the IMF’s latest World Economic Outlook, global growth is projected at 3.3% in 2026 and 3.2% in 2027. These figures were presented as evidence that the global economy has remained resilient despite successive shocks, including supply chain disruptions, inflationary pressures, and tighter financial conditions.

IMF Managing Director Kristalina Georgieva emphasized that uncertainty has become a structural feature of the global economy rather than a temporary phase. She noted that governments, firms, and households are increasingly operating in an environment shaped by frequent external shocks, ranging from climate events to trade disruptions and technological change.

The IMF attributed current economic resilience to several factors. These include a greater role played by the private sector in driving growth, the mitigation of trade tensions through exemptions and negotiated arrangements, and sustained investment in technology. Georgieva also highlighted that many governments have continued to deploy fiscal and monetary tools to support households and businesses, even as they face constraints related to debt sustainability.

At the same time, IMF officials warned that resilience should not obscure underlying vulnerabilities. Public debt levels remain elevated in many economies, and investment remains highly concentrated in specific sectors, particularly technology. The IMF cautioned that uneven access to capital and skills could widen productivity gaps between regions.

Artificial Intelligence as a Growth Driver

Artificial intelligence featured prominently throughout the Davos agenda, with leaders from technology firms, financial institutions, and international organizations addressing its economic implications. AI was repeatedly described not as a niche innovation but as a foundational technology with economic impact.

Investment in AI-related infrastructure, including data centers, computing hardware, and energy capacity, has accelerated over the past two years. Technology executives noted that AI deployment increasingly resembles large-scale infrastructure investment rather than traditional software development. This shift has implications for capital allocation, energy demand, and labor organization.

According to the IMF analysis presented at Davos, AI has the potential to increase global growth by up to 0.8 percentage points if deployed effectively. However, the distribution of these gains remains uncertain. The IMF reported that approximately 40% of jobs globally are expected to be affected by AI through transformation or displacement, with the figure rising to around 60% in advanced economies.

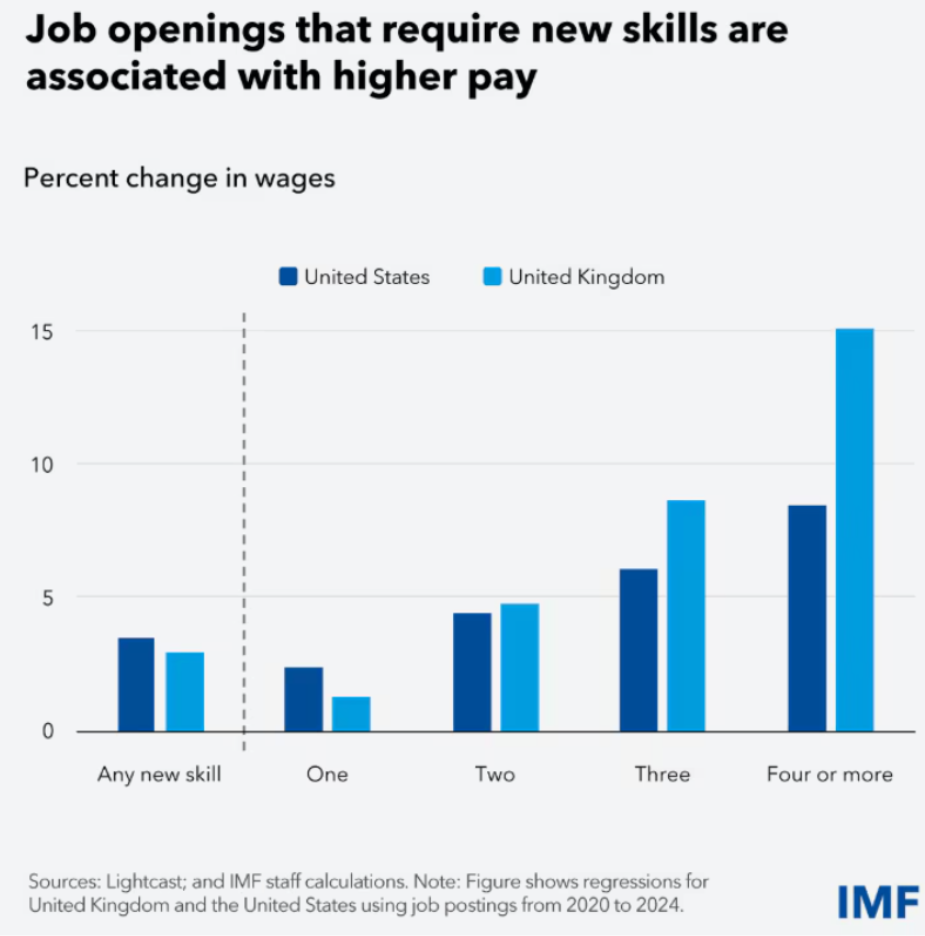

Despite concerns about job losses, IMF data indicates that employment has not declined in sectors where skills adoption has increased. Instead, roles that require new technical and analytical skills tend to be associated with higher wages and stronger employment outcomes. The IMF stressed that AI-driven productivity gains depend heavily on workforce adaptation and skills development.

Labor Markets and Skills

Labor market transformation was a central theme in discussions on technology and growth. Several sessions focused on the need for reskilling and upskilling as automation and AI adoption accelerate across industries.

IMF research presented at Davos showed that in advanced economies, one in ten jobs already requires at least one new skill compared to previous years. In some roles, up to four new skills are now required. At the same time, data suggests that a one percent increase in new skills adoption is associated with a 1.3% increase in overall employment.

Business leaders emphasized that the main constraint is no longer technological capability but human capital readiness. Companies reported difficulties finding workers with the combination of technical, analytical, and organizational skills required to integrate AI into existing processes. This has placed pressure on education systems, vocational training, and corporate learning programs.

International institutions highlighted the uneven distribution of skills across regions. While advanced economies face aging populations and labor shortages, many developing economies have young populations but limited access to capital, connectivity, and education infrastructure. Bridging this gap was identified as a key challenge for sustaining global growth.

Energy and Infrastructure Constraints

The expansion of AI and digital technologies has intensified focus on energy systems and infrastructure capacity. Data centers and high-performance computing require reliable electricity and cooling systems, placing additional strain on power grids.

Energy security was discussed as a foundational requirement for economic competitiveness. Participants noted that disruptions to energy supply can quickly translate into constraints on digital investment and industrial output. Several sessions highlighted the growing role of energy efficiency, renewable energy, and grid modernization in supporting digital transformation.

Leaders from the energy sector emphasized that investment in generation capacity must be accompanied by upgrades to transmission and distribution infrastructure. Without these upgrades, technological investment risks being bottlenecked by physical constraints.

Investment Patterns and Financial Stability

Financial sector discussions at Davos focused on the sustainability of current investment patterns, particularly in technology. While capital inflows into AI and related sectors have supported innovation, concerns were raised about valuation pressures and profitability timelines.

The IMF warned that enthusiasm for AI could outpace earnings delivery, potentially leading to corrections if expected returns fail to materialize. Given the concentration of investment in a limited number of firms and markets, such corrections could have broader financial implications.

Central bankers and regulators emphasized the importance of maintaining robust underwriting standards and monitoring exposure to highly valued sectors. They also reiterated the importance of central bank independence in managing inflation and maintaining financial credibility.

Technology Diffusion and Global Access

A recurring theme throughout Davos was the challenge of technology diffusion. While AI capabilities are advancing rapidly, access remains uneven across regions and income levels.

Connectivity gaps, unreliable electricity, and limited access to hardware continue to constrain adoption in many developing economies. International organizations stressed that without addressing these basic barriers, technological progress risks reinforcing existing inequalities.

Several sessions highlighted the need for coordinated investment in digital infrastructure, education, and regulatory frameworks to support broader participation in the digital economy. Technology leaders emphasized that global diffusion is essential not only for equity but also for maximizing the economic potential of AI and digital innovation.

Conclusion

The World Economic Forum Annual Meeting 2026 presented a detailed snapshot of an economy adapting to sustained uncertainty and rapid technological change. Economic resilience, driven by private sector activity and technological investment, has prevented the slowdown many had anticipated. At the same time, the concentration of growth drivers, particularly in technology, has introduced new vulnerabilities.

Artificial intelligence emerged as a central force shaping investment, labor markets, and infrastructure demand. However, its economic impact remains closely tied to skills development, energy capacity, and the ability of institutions to support diffusion.

Across sessions, leaders consistently emphasized that economic performance in the coming years will depend less on innovation alone and more on execution, infrastructure, and human capital readiness.