In economics, a soft landing refers to a situation where economic growth slows enough to reduce inflation, but not so much that it causes a recession. Demand cools, price pressures ease, and borrowing becomes more expensive, yet employment remains relatively strong and economic activity continues. The economy loses momentum, but it stays upright.

The term is most often used during periods when central banks raise interest rates to fight inflation. Higher rates are meant to reduce spending and investment gradually. A soft landing is achieved if inflation comes down while businesses continue operating, workers keep their jobs, and financial systems remain stable.

Why Central Banks Aim for It

Central banks are tasked with balancing two competing goals: price stability and economic growth. When inflation rises too fast, purchasing power erodes, and uncertainty increases. Raising interest rates is the main tool to slow demand and bring inflation under control.

Institutions such as the Federal Reserve attempt to calibrate policy carefully. If rates are raised too slowly, inflation can become entrenched. If they are raised too aggressively, borrowing costs rise sharply, investment falls, and layoffs follow. A soft landing sits in the narrow space between these outcomes.

Why Achieving Soft Landing Is So Difficult

Economic systems do not respond evenly or predictably to policy changes. Interest rate increases affect housing markets, corporate investment, and consumer borrowing relatively quickly. Labor markets, however, tend to react with a delay. By the time job losses appear, policy tightening may already have gone too far.

Expectations add another layer of difficulty. Businesses and households adjust behavior based not only on current interest rates, but on what they believe will happen next. If confidence weakens suddenly, spending can fall faster than policymakers intend, increasing the risk of recession even if inflation is still declining.

External factors also complicate matters. Energy price shocks, supply chain disruptions, or geopolitical tensions can push inflation higher independently of domestic demand. Central banks then face the challenge of slowing the economy to control prices that are not fully driven by local conditions.

What Soft Landing Looks Like in Practice

In a successful soft landing, economic growth slows from above-trend levels to a more sustainable pace. Inflation declines gradually rather than collapsing. Unemployment may rise modestly but remains contained. Corporate earnings are weakening but do not fall sharply, and credit markets continue functioning without major stress.

Financial markets during this phase are often volatile. Investors constantly reassess whether tightening has gone far enough or too far. However, systemic disruptions such as widespread bankruptcies or banking crises are avoided. The adjustment is uncomfortable, but manageable.

Soft Landing Versus Other Outcomes

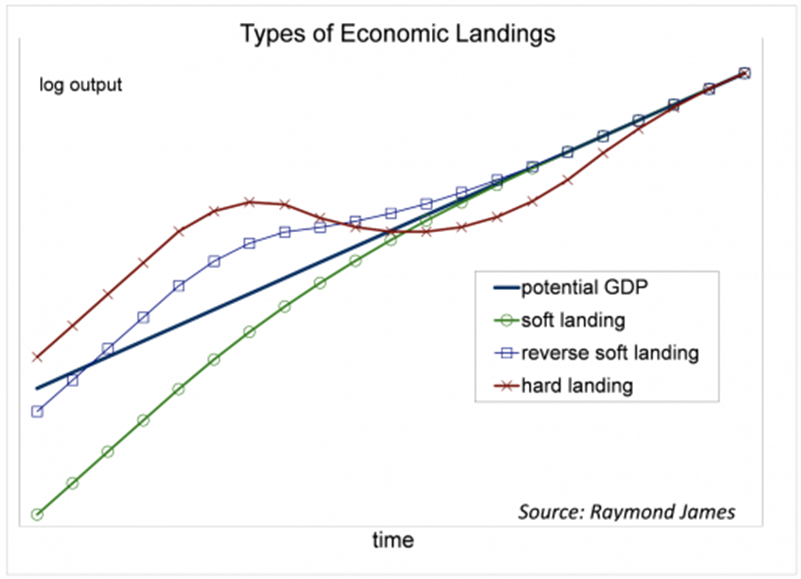

A soft landing is only one of several possible results of monetary tightening.

In a hard landing, inflation is reduced but at the cost of a recession. Economic output contracts, unemployment rises significantly, and household incomes come under pressure. Historically, this has been the more common outcome when inflation proves persistent.

A no landing scenario occurs when growth remains strong, and inflation stays elevated despite higher interest rates. In this case, central banks may be forced to keep rates higher for longer, increasing financial strain and raising the risk of a delayed downturn.

The soft landing represents the most balanced outcome, but also the most difficult to achieve.

Why Soft Landings Are Rare

Soft landings require precise timing, favorable economic conditions, and a degree of luck. Inflation expectations must remain anchored. Households and businesses must have strong balance sheets. Financial systems must absorb higher rates without triggering instability.

Historically, soft landings are often identified only in hindsight. During the process, uncertainty remains high, and policymakers must make decisions without knowing how the economy will respond months later.

Why The Term Dominates Economic Headlines

The phrase soft landing appears frequently because it captures the ideal result of tightening policy. It reflects hope that inflation can be controlled without widespread economic pain. At the same time, it signals uncertainty, as such outcomes are difficult to predict and even harder to deliver.

Soft landings are often declared prematurely, before the full effects of policy are visible. In reality, confirmation comes only after inflation has fallen and growth has remained intact over time.

The Broader Implication

A soft landing is not a single decision or announcement. It is a process shaped by policy choices, market reactions, and external shocks. When achieved, it limits economic damage and preserves confidence. When missed, the costs are felt across households, businesses, and financial systems.

Understanding what a soft landing truly means helps explain why central banks move cautiously, why markets react so sharply to economic data, and why economic outcomes often look uncertain even when policy goals appear clear.