Economic nihilism refers to a rising belief that individual actions no longer influence economic outcomes. It is not a formal academic theory but rather a broad psychological and social trend that captures growing skepticism toward traditional economic pathways. People increasingly feel that the link between effort and reward is weakening, and the economic system is too volatile, too unequal or too unpredictable to offer a reliable future. This mindset has emerged gradually, shaped by the combined pressures of financial instability, political turbulence and rapid technological change. As a result, it is influencing how individuals work, save, spend and plan for the long term. In a business environment that depends heavily on consumer and employee confidence, this shift is important to understand.

Sources of Contemporary Economic Nihilism

A major driver of this attitude is prolonged uncertainty. The global financial disruptions of the past decade, from the pandemic to inflationary shocks and geopolitical tensions, have created an environment in which economic norms seem to break down. Households have watched interest rates rise far faster than wages, making home ownership and long-term planning increasingly difficult. Studies show that even when nominal incomes grow, the real cost of living often outpaces them, especially in housing, energy and essential goods. When people feel they are permanently “catching up,” a sense of futility can develop.

Another contributor is declining trust in traditional institutions. Central banks, governments, and large corporations face more scrutiny and criticism than ever before. When these institutions struggle to deliver stability or demonstrate transparency, the public becomes less willing to believe in the fairness or logic of the system. Financial markets appear increasingly complex, dominated by algorithmic trading, technological barriers, and new asset classes that feel detached from everyday life. For many, the result is disengagement: if the rules seem designed for someone else, why play the game at all?

How Gen Z Lives and Thinks in an Age of Disillusionment

Gen Z represents the clearest reflection of economic nihilism today. Born into recession, raised during political polarization, and entering adulthood amid inflation and housing crises, this generation has never experienced a period of sustained economic optimism. Their lifestyle choices reflect both adaptation and resistance to economic norms. They tend to value flexibility over stability, preferring freelance arrangements, hybrid work, or project-based careers that allow them to maintain control in an unpredictable environment. This is not merely preference; it is a response to shrinking job security and rising living costs.

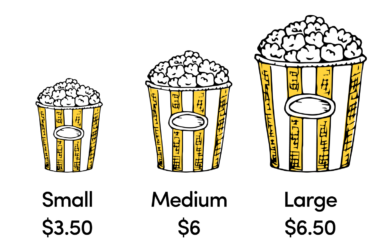

Gen Z is also more cautious with major financial commitments. Home ownership feels unreachable for many, so renting, co-living, or delaying traditional milestones has become normal. Their consumption habits lean toward affordable luxuries, such as small experiences, wellness products, and digital entertainment, rather than long-term assets. This pattern is often misunderstood as impulsiveness, but research suggests it stems from a rational assessment: when the future feels uncertain, enjoying the present becomes a form of psychological stability.

At the same time, Gen Z is highly informed and digitally fluent. They consume economic information constantly, from social media explanations of inflation to viral commentary on corporate behavior. This exposure, however, can generate both literacy and cynicism. Online economic spaces mix expert insight with misinformation, creating a constant stream of contradictory narratives. The result is a generation that is aware of global economic dynamics but skeptical that they can meaningfully influence them. Their engagement with cryptocurrency, meme stocks, or viral investment trends illustrates this tension: high-risk behavior driven not by ignorance but by a belief that traditional methods no longer offer reliable returns.

Behavioral Consequences

Economic nihilism does not remain theoretical; it directly affects consumer, employee and investor behavior. Many individuals adopt short-term thinking, prioritizing immediate well-being over long-term planning. Savings rates tend to fall, while spending on convenience, entertainment and small comforts increases. Risk-taking rises at both ends of the spectrum; some pursue speculative investments, while others refuse to invest at all, convinced that markets are inherently biased. In the workplace, this attitude shows up as disengagement, reduced loyalty, and a preference for roles that offer autonomy rather than hierarchy. Employees increasingly expect transparency, mental-health support, and clear communication because these are the few stabilizing forces companies can offer in an unpredictable world.

Looking Forward

Economic nihilism is not merely a generation-specific trend; it represents a deeper questioning of economic fairness and long-term progress. While this sentiment can soften as conditions improve, it has already reshaped attitudes toward work, consumption, and financial planning. Businesses that understand this shift and adapt to the new expectations it creates will be better positioned to connect with consumers and employees who want clarity, honesty, and purpose. In an era where trust is fragile, organizations that provide consistency may become the few remaining points of confidence in a complex economic landscape.